How Much are Used Car Sales Taxes in Ohio?

Buying a used car in Ohio is a great way to save some money, but there’s one thing you can’t ignore: the sales tax. The statewide rate for used car sales tax in the state of Ohio is 5.75% of the vehicle’s purchase price.

Local counties also charge sales tax, so depending on where you live, the total rate could be much higher than the state’s 5.75%. On top of that, you have to factor in registration fees and the cost of a title transfer in Ohio state.

We’re here to help you understand everything about motor vehicle sales taxes and fees in the state of Ohio.

We’re here to help you understand everything about motor vehicle sales taxes and fees in the state of Ohio.

Do You Pay Taxes When You Buy a Car From a Private Party in Ohio?

When buying a car in Ohio, you’ll pay 5.75% (plus applicable local tax) of the vehicle’s purchase price, whether you buy from a private seller or a car dealer. The tax law does not discriminate between the two.

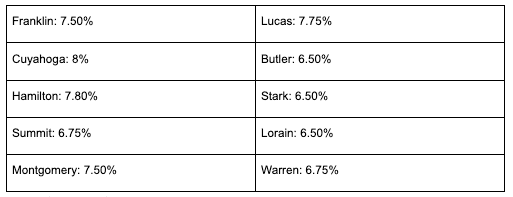

Some Ohio counties charge higher local taxes than others. Here is a table of combined car sales tax rates (state and local) for the largest counties by population in Ohio:

Some Ohio counties charge higher local taxes than others. Here is a table of combined car sales tax rates (state and local) for the largest counties by population in Ohio:

For a full list of counties and their respective sales tax rates, check out the official Ohio Department of Taxation website.

Sales tax rates vary and are subject to quarterly rate changes. For example, in 2023S first quarter rate change (effective January 1, 2023), the sales tax for Warren County decreased from 7% to 6.75%. Before making a purchase, check the updated tax information with your local authorities to avoid surprises.

Sales tax rates vary and are subject to quarterly rate changes. For example, in 2023S first quarter rate change (effective January 1, 2023), the sales tax for Warren County decreased from 7% to 6.75%. Before making a purchase, check the updated tax information with your local authorities to avoid surprises.

Ohio Registration, Title, and License Plate Fees

In addition to the state and county sales tax, other fees are involved with purchasing a car, such as registration fees and vehicle title fees.

Transferring a title in the state of Ohio costs $15. A duplicate vehicle title will cost you the same.

You have to register your car every year in Ohio. The annual registration renewal fees for a passenger car are $31. If you fail to renew your vehicle registration for more than 30 days after the purchase, you pay a $10 late fee.

When you register your car, you will also be charged for the vehicle’s license plates. Ohio license plates cost $25 if you stick with standard plates. For a plate and registration transfer, you will pay $6. In case you need a duplicate of your registration, you’ll pay another $6.

You have to register your car every year in Ohio. The annual registration renewal fees for a passenger car are $31. If you fail to renew your vehicle registration for more than 30 days after the purchase, you pay a $10 late fee.

When you register your car, you will also be charged for the vehicle’s license plates. Ohio license plates cost $25 if you stick with standard plates. For a plate and registration transfer, you will pay $6. In case you need a duplicate of your registration, you’ll pay another $6.

Can I Transfer and Register an Out of State Vehicle in Ohio?

You can register an out-of-state vehicle in Ohio by following these steps:

1. Get hold of your out-of-state title, as you'll need to convert it to an Ohio title.

2. Complete the "Application for Certificate of Title to a Motor Vehicle" (Form BMV 3774).

3. Have your vehicle's identification number (VIN) inspected by an authorized agent in Ohio.

4. Pay the required fees for titling, registration, and any applicable taxes.

5. Visit your local Ohio Bureau of Motor Vehicles (BMV) office with all necessary documents and fees in hand.

6. If your car has a lien, you may need a lien release from the lienholder. If your lienholder has your title, complete a transfer request form and send it to the lienholder. (You’ll find the form at the County Clerk of Courts Title Offices.)

7. For more information, check out our in-depth guide to transferring an Ohio car title.

1. Get hold of your out-of-state title, as you'll need to convert it to an Ohio title.

2. Complete the "Application for Certificate of Title to a Motor Vehicle" (Form BMV 3774).

3. Have your vehicle's identification number (VIN) inspected by an authorized agent in Ohio.

4. Pay the required fees for titling, registration, and any applicable taxes.

5. Visit your local Ohio Bureau of Motor Vehicles (BMV) office with all necessary documents and fees in hand.

6. If your car has a lien, you may need a lien release from the lienholder. If your lienholder has your title, complete a transfer request form and send it to the lienholder. (You’ll find the form at the County Clerk of Courts Title Offices.)

7. For more information, check out our in-depth guide to transferring an Ohio car title.

How to Pay Ohio Vehicle Sales Tax

Here's how to pay car sales tax in Ohio when you buy a used car from a private seller:

1. You and the seller must complete the necessary paperwork to transfer ownership of the vehicle, including the vehicle bill of sale. If you choose to buy a car on PrivateAuto, we will provide an official Ohio bill of sale and prompt both of you to sign it in our app at the appropriate stage of the transaction process.

2. Calculate the amount of sales tax due depending on the state sales tax rate. The Ohio sales tax on cars is 5.75% plus applicable county taxes. For example, if you’re buying a car in Warren County, multiply the vehicle's purchase price by 0.0675 (6.75% in combined city/county sales tax). If you paid $10,000 for a car, the sales tax would be $675.

3. Sign the Ownership Assignment and Title Application for Casual Sale form.

4. Submit your Affidavit for Registration form.

5. Submit payment for all taxes and fees.

6. Get your new registration and title. Once you've paid the sales tax and turned in the necessary paperwork, you'll get your new registration and title for the car. The title and registration will show that you bought the car and that the sales tax has been paid. You will also get new license plates.

If you buy a car in a state that levies no sales tax and register it in that same state, you won’t pay Ohio sales tax if you later register it in Ohio. If you immediately register your new-to-you car in Ohio right after purchasing it in another state, you’ll pay Ohio sales tax.

1. You and the seller must complete the necessary paperwork to transfer ownership of the vehicle, including the vehicle bill of sale. If you choose to buy a car on PrivateAuto, we will provide an official Ohio bill of sale and prompt both of you to sign it in our app at the appropriate stage of the transaction process.

2. Calculate the amount of sales tax due depending on the state sales tax rate. The Ohio sales tax on cars is 5.75% plus applicable county taxes. For example, if you’re buying a car in Warren County, multiply the vehicle's purchase price by 0.0675 (6.75% in combined city/county sales tax). If you paid $10,000 for a car, the sales tax would be $675.

3. Sign the Ownership Assignment and Title Application for Casual Sale form.

4. Submit your Affidavit for Registration form.

5. Submit payment for all taxes and fees.

6. Get your new registration and title. Once you've paid the sales tax and turned in the necessary paperwork, you'll get your new registration and title for the car. The title and registration will show that you bought the car and that the sales tax has been paid. You will also get new license plates.

If you buy a car in a state that levies no sales tax and register it in that same state, you won’t pay Ohio sales tax if you later register it in Ohio. If you immediately register your new-to-you car in Ohio right after purchasing it in another state, you’ll pay Ohio sales tax.

Vehicle Purchase Price vs Fair Market Value

In Ohio, sales tax is calculated based on the vehicle's purchase price. There are people who think they can outsmart the government by negotiating a low "official" purchase price and paying the rest in a side transaction. But the Ohio Bureau of Motor Vehicles (BMV) can’t be fooled so easily.

If the BMV suspects that the purchase price of the vehicle was artificially decreased, they will calculate sales tax based on the car’s fair market value. The BMV establishes what the car is worth on the open market by referring to the Kelley Blue Book or other reliable sources on used car prices. If the BMV concludes that the car's fair market value is greater than the selling price, the sales tax can be assessed based on the fair market value.

If the BMV suspects that the purchase price of the vehicle was artificially decreased, they will calculate sales tax based on the car’s fair market value. The BMV establishes what the car is worth on the open market by referring to the Kelley Blue Book or other reliable sources on used car prices. If the BMV concludes that the car's fair market value is greater than the selling price, the sales tax can be assessed based on the fair market value.

How to Avoid Paying Sales Tax on a Car in Ohio?

There’s no way around it—property taxes, income taxes, sales taxes, and other taxes are part of life. All motor vehicle sales are subject to sales tax in Ohio or any other state that charges vehicle sales tax—unless you meet an exemption.

Ohio Car Sales Tax Exemptions

Here are some sales tax exemptions for used vehicle purchases in Ohio:

•

Exemptions may apply to motor vehicles employed in the production of agricultural goods for sale.

•

If the vehicle is purchased by and titled as a part of an organization, churches and nonprofit charitable organizations may be excluded from the requirement.

•

Motor vehicles that are employed in the direct production or extraction of geologically classified minerals for sale are exempt from sales tax. Vehicles used to transport minerals from the excavation or extraction location to a plant, factory, or tipple where the extracted substance is to be processed by the person operating such a mining operation are also exempt from taxation.

•

Sales tax is not applied to the purchase of motor vehicles by the federal government or any of its agencies.

•

For the transfer of a vehicle to a buyer where the seller will arrange for delivery outside of Ohio, an exemption may be requested.

•

Sales to non-Ohio residents who buy the car in the state but claim they will immediately remove and title the vehicle outside of Ohio are typically exempt from paying sales tax.

Do I Pay Sales Tax on Out of State Cars?

Whether you purchase a motor vehicle in the state of Ohio or in another state, you need to register it, pay for the title transfer and license plates, and pay any applicable state and county sales tax.

Depending on the county in which you live and register your car, you will pay Ohio’s flat rate of 5.75% plus additional county taxes. For example, if you’re a Fulton resident, you will pay 7.25% in state and county sales tax.

Is Buying from a Dealer Better?

Many people think buying from car dealers saves them tons of time and money. The truth is, when you go to a dealer, you end up paying more.

When you buy a car from a dealer, you pay all the same taxes and fees that you would if you bought it from a private seller. Dealers have a way of rolling it all up in the fine print, but the charges are still there.

Perhaps more significantly, nine times out of ten, you’ll pay more for a used vehicle when you buy it from a dealer, compared to buying the same vehicle from a private party. That’s because dealers need to buy low and sell high to make a profit. Cut out the middleman and get the best price possible by transacting peer-to-peer on PrivateAuto.

Additionally, dealerships charge a "documentation fee" above and beyond all the other taxes and fees you have to pay. Car dealers in Ohio are allowed to charge a documentation fee of up to $250.

We do admit that dealers bring a certain amount of convenience that you don’t traditionally get when you buy from a private seller. In fact, that’s why PrivateAuto exists. We give you dealer-like convenience in the palm of your hand while allowing you to transact peer-to-peer with regular folks like yourself.

Avoid documentation fees and get lower prices when you shop used cars from private sellers right here on PrivateAuto.

When you buy a car from a dealer, you pay all the same taxes and fees that you would if you bought it from a private seller. Dealers have a way of rolling it all up in the fine print, but the charges are still there.

Perhaps more significantly, nine times out of ten, you’ll pay more for a used vehicle when you buy it from a dealer, compared to buying the same vehicle from a private party. That’s because dealers need to buy low and sell high to make a profit. Cut out the middleman and get the best price possible by transacting peer-to-peer on PrivateAuto.

Additionally, dealerships charge a "documentation fee" above and beyond all the other taxes and fees you have to pay. Car dealers in Ohio are allowed to charge a documentation fee of up to $250.

We do admit that dealers bring a certain amount of convenience that you don’t traditionally get when you buy from a private seller. In fact, that’s why PrivateAuto exists. We give you dealer-like convenience in the palm of your hand while allowing you to transact peer-to-peer with regular folks like yourself.

Avoid documentation fees and get lower prices when you shop used cars from private sellers right here on PrivateAuto.

Ohio Car Sales Tax Calculator

If you’re in the market for a used car, you need to figure out how much sales tax you owe. While you don’t have to be a rocket scientist to calculate taxes, it can be a hassle to get to the bottom of your total sales tax amount.

With PrivateAuto’s used car sales tax calculator, figuring out sales tax has never been easier. This free online tool makes it hassle-free to calculate how much tax you have to pay on a used car purchase based on where you live and the purchase price of the car.

With PrivateAuto’s used car sales tax calculator, figuring out sales tax has never been easier. This free online tool makes it hassle-free to calculate how much tax you have to pay on a used car purchase based on where you live and the purchase price of the car.

Buy and Sell Used Cars on PrivateAuto

Conduct private car transactions easily and safely with PrivateAuto. Our innovative platform connects buyers and sellers and gives them all the tools to complete the deal, from in-app financing to secure messaging to integrated payments.

PrivateAuto allows you to negotiate the price you want, schedule the test drive meetup, and pay for the car—all within our app without compromising your personal information.

Whether you want to shop used vehicles for sale or are trying to sell your used car for top dollar, PrivateAuto will help you get the deal done.

Get started with PrivateAuto today.

Here’s how you can sell your car in Ohio with a few simple steps:

1. Gather necessary documentation

You’ll need your vehicle title and other documentation. Have all the paperwork you need to sell your car privately, so you’re not scrambling to find it at the moment of completing a sale.

2. Register on PrivateAuto and get verified

To make PrivateAuto a safe place for everyone, we require email, phone, and driver’s license verification, including facial recognition.

3. List your car

Easily create your PrivateAuto listing with our step-by-step guide. Bonus: we include a window brochure with a QR code scannable to your listing.

4. Set your terms

It’s your car, so you drive the deal! You can control where, when, and who you meet. Decide whether to accept only ID-verified buyers, or buyers with verified funds. Don’t waste your time with buyers who aren’t verified according to your preferences.

5. Vet incoming offers

Manage offers in one place with the ability to accept, reject, or counter offers within the app. Listing on multiple sites? Filter all communications through PrivateAuto by sharing your listing link on all platforms. Your personal info is protected: no more giving out your phone number or email address. All communication happens in our app.

6. Choose a buyer

When you find an offer you like, accept it and proceed to the next step with that buyer.

7. Schedule a meeting

The buyer will want to look at your car. No more back-and-forth texts. You never have to give out your phone number. Rather, use our handy scheduling feature to schedule test drives and coordinate a time and place for meetings. (Oh, and you’ll be able to finalize the transaction instantly at the first meeting, FYI.)

8. E-sign documents

After the buyer is satisfied with your car and the two of you have agreed on a purchase price, you can easily e-sign the bill of sale within our app, from your phone. With our shared documents feature, you can easily locate the paperwork needed after the sale.

9. Get paid, instantly

Before PrivateAuto, receiving funds was the most stressful part of the entire selling process, especially for any used car sale over $5,000. There just aren’t a lot of good ways to move large amounts of money quickly and conveniently. Those days are over! Verify and receive funds instantaneously with PrivateAuto Pay, our innovative banking integration. Guaranteed funds for transactions large and small.

10. Transfer title

When you sell your vehicle, fill out the necessary information on the back of the Certificate of Title and sign in order to transfer ownership of the vehicle to the new owner.

PrivateAuto allows you to negotiate the price you want, schedule the test drive meetup, and pay for the car—all within our app without compromising your personal information.

Whether you want to shop used vehicles for sale or are trying to sell your used car for top dollar, PrivateAuto will help you get the deal done.

Get started with PrivateAuto today.

Here’s how you can sell your car in Ohio with a few simple steps:

1. Gather necessary documentation

You’ll need your vehicle title and other documentation. Have all the paperwork you need to sell your car privately, so you’re not scrambling to find it at the moment of completing a sale.

2. Register on PrivateAuto and get verified

To make PrivateAuto a safe place for everyone, we require email, phone, and driver’s license verification, including facial recognition.

3. List your car

Easily create your PrivateAuto listing with our step-by-step guide. Bonus: we include a window brochure with a QR code scannable to your listing.

4. Set your terms

It’s your car, so you drive the deal! You can control where, when, and who you meet. Decide whether to accept only ID-verified buyers, or buyers with verified funds. Don’t waste your time with buyers who aren’t verified according to your preferences.

5. Vet incoming offers

Manage offers in one place with the ability to accept, reject, or counter offers within the app. Listing on multiple sites? Filter all communications through PrivateAuto by sharing your listing link on all platforms. Your personal info is protected: no more giving out your phone number or email address. All communication happens in our app.

6. Choose a buyer

When you find an offer you like, accept it and proceed to the next step with that buyer.

7. Schedule a meeting

The buyer will want to look at your car. No more back-and-forth texts. You never have to give out your phone number. Rather, use our handy scheduling feature to schedule test drives and coordinate a time and place for meetings. (Oh, and you’ll be able to finalize the transaction instantly at the first meeting, FYI.)

8. E-sign documents

After the buyer is satisfied with your car and the two of you have agreed on a purchase price, you can easily e-sign the bill of sale within our app, from your phone. With our shared documents feature, you can easily locate the paperwork needed after the sale.

9. Get paid, instantly

Before PrivateAuto, receiving funds was the most stressful part of the entire selling process, especially for any used car sale over $5,000. There just aren’t a lot of good ways to move large amounts of money quickly and conveniently. Those days are over! Verify and receive funds instantaneously with PrivateAuto Pay, our innovative banking integration. Guaranteed funds for transactions large and small.

10. Transfer title

When you sell your vehicle, fill out the necessary information on the back of the Certificate of Title and sign in order to transfer ownership of the vehicle to the new owner.

Ohio Car Sales Tax FAQ

Does Ohio require a front license plate?

According to Ohio law, a registered motor vehicle is required to have just one distinctive license plate visible on the rear. If you decide to put your license plate on the front, it must match your back plate.

Read more on which states require front license plates.

Read more on which states require front license plates.

Do I need a separate title application to transfer the vehicle’s ownership?

Can I transfer an Ohio title after my spouse’s death?

How many years can you register a car in Ohio?

Do I owe sales tax if I purchased a vehicle out of state and moved to Ohio?

Is sales tax due when I’m receiving the title of a vehicle due to divorce?

How much will I pay for a specialized license plate?

Which state has the cheapest car tax?

Dana Marchlowitz

Contributing Author

Dana is a seasoned executive with a strong background in startups and product management. Currently serving as the Chief Product Officer for PrivateAuto, Dana brings a wealth of knowledge and expertise to the role....