Can I pay for a car with PayPal or Venmo?

Which Payment Methods Allow Large Purchases?

Many popular payment methods cap out at $5,000, $10,000, or some other threshold. For example, Venmo has a limit of $4,999. Of the methods that allow large fund transfers, all except PrivateAuto Pay are full of problems. Here they are:- Bank transfer

- Physical cash

- Personal check

- Cashier’s check

- Bank draft

- Escrow service

The problem of cash transactions

Are Cash Transactions Safe?

If you’ve got the funds, paying the full sale price in cash can save you thousands of dollars in interest payments. But lugging around a bunch of physical cash is a hassle, risky, and awkward. Who wants to meet up with a stranger carrying $41,624 in bills to buy that Jeep Gladiator? Here are the main drawbacks to using physical cash as a method of payment:- Paperwork: do you know how to do the bill of sale and title transfer for your state? Will you have a record of the transaction in case the other party wants to contest it?

- Trust: do you know the person you’re dealing with? No one wants to risk getting scammed or robbed by a complete stranger.

- Inconvenient: ATMs and banks have withdrawal limits. If you’re trying to do it on the weekend, forget about the car.

- Counting out bills: just imagine counting out $41,624 in bills in front of a stranger. It takes a long time and it’s awkward.

- Counterfeit cash: while counterfeiting is rare, can you prove to the seller that the bills are genuine? Are they going to trust you?

Are Personal Checks a Good Form of Payment?

A personal check doesn’t fly for most sellers; no one wants to sit around waiting for it to clear. And you probably don’t want to cut the check, and then wait several days before getting the car when the funds hit the seller’s account. Too many steps, too much trust needed, too much time wasted. What should be a quick peer-to-peer payment turns into a headache.Using a cashier’s check for a private auto sale

How About a Cashier Checks?

Cashier’s checks are more trustworthy than personal checks, but even they’re not bulletproof. Plus, they’re inconvenient. Cashier’s checks can be forged; the only way for the seller to be certain is to meet you at your bank and have the bank verify the funds. Skip the inconvenience and enjoy instant digital payments with PrivateAuto Pay. Round-the-clock availability means no banking hours restricting transactions.Paying for a car with a wire transfer

What About Bank Transfers?

Traditional bank wire transfers are packed with limitations.- Potentially risky. Sellers don’t like exposing their bank account details because of the risk of fraud.

- Slow. Transfers can take days to fully process.

- Transfer limits. Your bank may have limits on how much can be transferred at once, necessitating multiple transfers. This delays sales and frustrates sellers.

- Fees. Bank wires often cost money.

Are Bank Drafts Safe?

While more secure than a personal check, bank drafts have some drawbacks when purchasing a high-value vehicle. Drafts take several days to clear. Nobody wants to wait that long to get the deal done. And you don’t want to send the money, only to wait several days for your car.Can I Use an Escrow Service?

A legitimate escrow service can solve the problem of trust between strangers. Unfortunately, escrow services are expensive, time-consuming, and cumbersome. PrivateAuto gives you escrow-like safeguards in the palm of your hand. Where escrow services charge fees, PrivateAuto Pay enables instant, fee-free payments.The advantage of PrivateAuto Pay

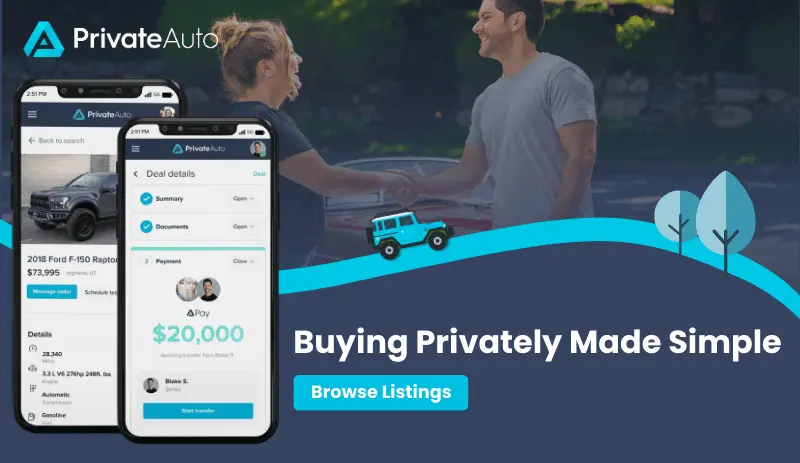

PrivateAuto Pay Is Your Answer

PrivateAuto Pay is our built-in banking integration that enables instant, secure, and unlimited fee-free fund transfers. Whether you need to send $30K for a Silverado or $800K for a Ferrari, the funds will appear in the seller’s account in seconds—and you won’t be charged a cent for the transfer. It’s a dream come true for buyers.- Your PrivateAuto Pay account is an FDIC-insured bank account you own, accessed via your PrivateAuto dashboard.

- Instantaneous transfers enable real-time deals—no waiting or coordination. Close the deal when you meet for the test drive.

- Instant payments work 24 hours a day, 365 days a year. No coordinating around banker’s hours.

- Easily move money from your bank account to PrivateAuto Pay and vice versa. A balance transfer can be done 24/7/365.

- No exchange of contact information or banking info—your sensitive info stays safe, protecting you from scammers.

- Encrypted data protects you from hackers.

- You can even buy a car remotely with our escrow-like safeguards.

What to Do After You Buy a Car from a Private Seller?

Key steps after buying a car privately include registering the vehicle, transferring the title, and getting new license plates issued in your name (unless you’re in California or Minnesota).

Here are some more details on handling those specific post-purchase tasks:

- Before driving off, contact your insurance company to add the car to your policy. You typically need valid insurance in your name to drive legally. Make sure you have proof of insurance.

- Head to the DMV as soon as possible to transfer the title to your name and register the car. Bring the title, bill of sale, ID, and insurance documents. Pay any required sales taxes and registration fees.

- The DMV will provide you with new registration documents and license plates for the car in your name. These are required to drive the car legally.

- All states except California and Minnesota: remove the old license plates and put on the new ones. Destroy the old registration and replace it with the new one for your records.

- Consider having the car inspected for safety and emissions testing if required in your state. The DMV can provide guidance.

- Notify your insurance company that the car is now registered in your name. Provide them the new VIN, plates, and registration.

Payments FAQ

How to avoid fraud when buying a car?

Unfortunately, when purchasing a car privately, fraud is a concern. Criminals use a variety of methods, such as faked vehicle history, odometer tampering, or title scams.

PrivateAuto offers vehicle history reports with all premium listings, and also has identity verification. These measures cut down significantly on fraudsters—but it always pays to be vigilant.

Don’t let a seller rush you into accepting a high price or paying without verifying the details and test driving. If a seller gives you a high-pressure “act now or lose out” request, it’s best to walk away. If the car is priced fairly, there will be other listings available without undue seller pressure.

The key is taking your time—carefully inspecting the car, verifying the VIN, test driving carefully, and not paying until you’re confident about going through with the transaction.

PrivateAuto helps by letting you schedule test drives securely and make payments only when terms are met. With a little patience, you can find the right car without being rushed into a fraudulent deal.

How to transfer the vehicle title?

When you meet the seller to do the deal, they will transfer the title to you. You’ll then need to complete the title transfer process at the DMV (or your state’s equivalent agency).

A bill of sale is required in some states, but it is a good idea to sign one regardless, as it gives you written evidence of the transaction and the agreed-upon sale amount in case there’s a dispute later on.

PrivateAuto automates the bill of sale by giving you an official bill of sale for your state. You and the seller sign it inside their PrivateAuto mobile app, and it stays there in your account for reference. If there’s ever a question of the sale’s legitimacy, you have this document to back you up.

To learn more, read our complete guide to the bill of sale and why it matters.

When I buy a car from a private seller, can I drive it home?

Most states require the seller to remove their license plates before turning the car over to you, so you’ll be driving without plates. You should check with your local DMV to see what they advise.

In general, here’s what to know about driving your new-to-you vehicle home after the purchase.

- In most states, you can legally drive a newly purchased vehicle home without temporary tags or registration, provided you have a bill of sale and title transfer paperwork with you. However, be sure to check your state’s DMV regulations before hitting the road.

- Some states do give temporary registration tags that let you drive for a short period before receiving permanent plates in the mail. For example, in California, you can get a temporary operating permit to drive for 90 days after a private party purchase. Check with your local DMV on options.

- If registering the car immediately, some DMV offices can provide same-day temporary permits after processing the title transfer paperwork.

- If you already have auto insurance, contact your provider to add the new car to your policy before driving it. If not, you’ll need to purchase a new policy. Insurance is required to drive legally.

- Keep documentation like the bill of sale, title paperwork, and insurance card with you when first driving the car. Be prepared to explain the situation if pulled over before receiving plates.

You might find our state-by-state guide to license plates a handy resource. It covers what happens with license plates when a used car is sold, and you can learn more about the requirements of your state.

What paperwork is needed to buy a car from a private seller?

Check your specific state laws for required paperwork when buying privately. Here are some common documents:

– Bill of sale

– Vehicle title

– Registration

– Release of liability

– Odometer statement

– Proof of auto insurance

– State ID

– Inspection forms

What is the maximum amount for a cashier's check?

There is no universally standard maximum amount for cashier’s checks, but most banks impose limits in the range of $10,000 to $50,000.

Here are some common cashier’s check maximums at major U.S. banks:

– Bank of America: $10,000 per check

– Wells Fargo: $10,000 per day

– Chase: $10,000 per check

– Citi: $15,000 per check

– TD Bank: $7,500 per check

– US Bank: $50,000 per check

For amounts above the cashier’s check limit, banks may issue an official bank check, which operates like a cashier’s check for larger sums. Bank checks usually need to be specially requested and take longer to get.

What’s the best way to pay for a car on Craigslist?

The easiest way to pay for a car on Craigslist is to invite the seller to DealNow. Craigslist doesn’t have a payment system, so a buyer and a seller need to navigate payment outside the platform.

Don’t fall for Craigslist scams: make frictionless payments via PrivateAuto Pay’s fee-free, unlimited transfers between accounts in seconds.

Further Reading

Dana Marchlowitz

Contributing Author

Dana is a seasoned executive with a strong background in startups and product management. Currently serving as the Chief Product Officer for PrivateAuto, Dana brings a wealth of knowledge and expertise to the role….